Today’s intraday session saw additional losses for the Pakistani Rupee (PKR) versus the US Dollar (USD).

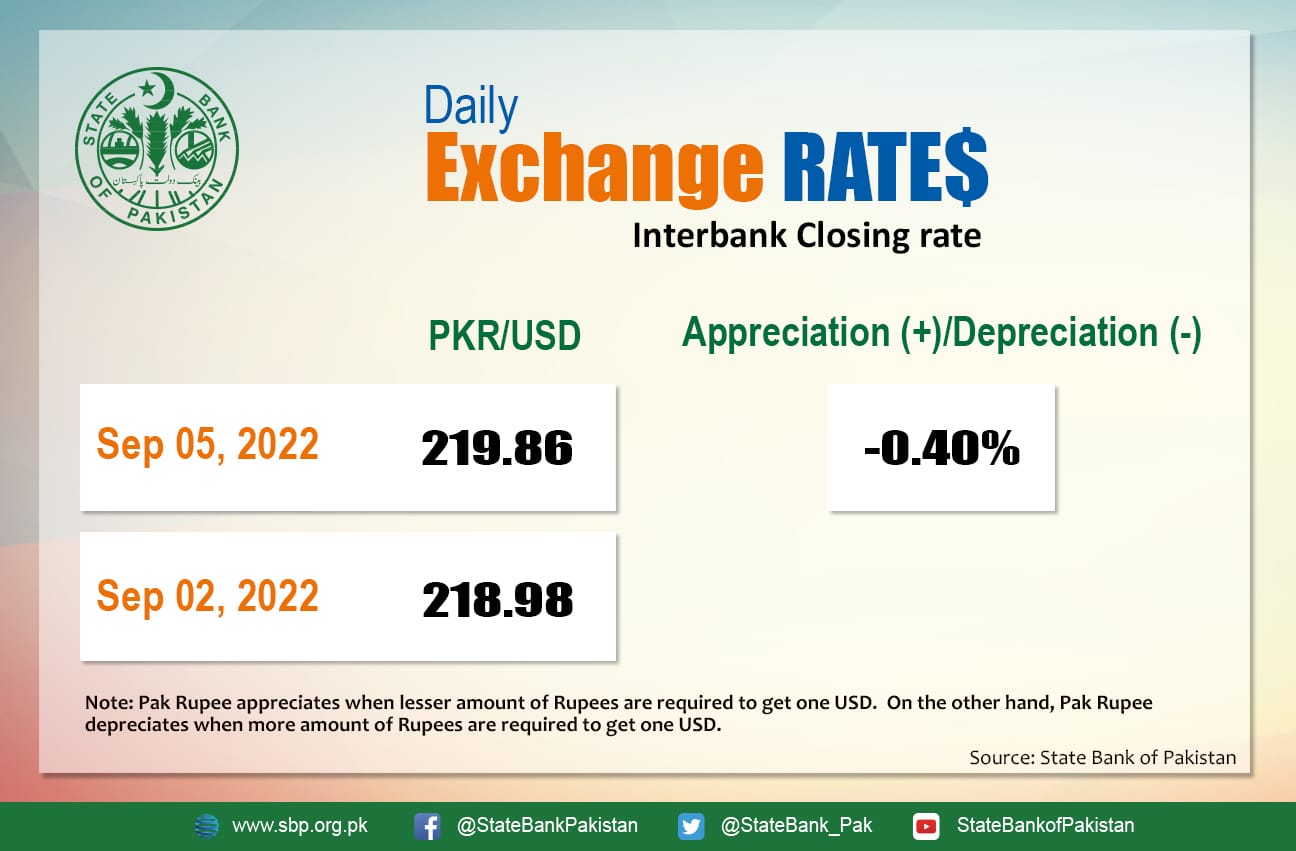

It dropped 88 paisas in today’s interbank market and lost 0.40 percent, or Rs. 219.86, to the US dollar. During today’s open market session, the local currency was reported at a day low of Rs. 220.98 versus the US dollar.

The local currency stayed flat against the US dollar in the morning and reached a peak of 218.25 at 11:03 AM on the open market. By lunchtime, the dollar climbed as high as 220.54 versus the rupee. Before the interbank closure, after 2 PM, the local currency traded at a range of 219–220 against the top foreign currency.

Even though the International Monetary Fund (IMF) disbursed a loan of $1.1 billion last week, the rupee reported losses versus the dollar today for the second straight day as markets struggled.

Despite the fact that Moody’s Investors Service rated Pakistan’s IMF loan disbursement and programme renewal as a “credit positive,” money changers had another lacklustre close today.

Based on the supposition that the South Asian country maintains engagement with the IMF over the remaining period of the EFF and persistently enforces structural reforms to support sustainable growth, the top rating agency anticipates Pakistan to be able to fully meet its financing needs for fiscal 2023 and the very next few years.

Political risk is still high, according to Moody’s, which will make policies less stable and predictable.

The organization also said that “social risks are also heightened” and that the continuous floods will increase rising inflation in the nation and increase imports. It went on to say that “damage to crops and infrastructure risks fiscal slippage and makes Pakistan’s ability to implement tax reforms and reduce expenditure more difficult.”

As the margin between interbank rates eased up before abruptly declining, the behaviour of the rupee in the open market attracted attention once again. The currency is expected to see some pressure as Pakistan attempts to import more basic goods in the wake of the nation’s floods.

On Monday, oil prices soared globally, rising more than $2 a barrel as traders anticipated potential actions by OPEC+ members to reduce production and boost prices at a meeting later in the day.

While US West Texas Intermediate (WTI) rose by 2.50 percent to close at $89.04 per barrel, Brent crude increased by 2.73 percent to $95.56 per barrel. It is important to remember that US markets are closed today due to a national holiday.

Oil prices have dropped from multi-year highs hit in March because to concerns that COVID-19 restrictions in certain regions of China and interest rate rises would stifle global economic development and reduce oil consumption.

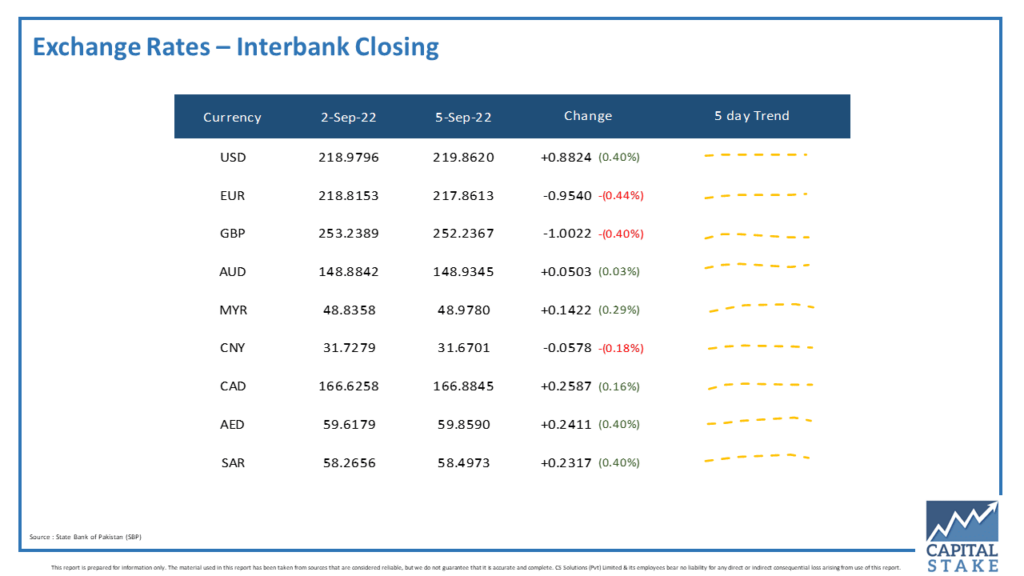

In today’s interbank market, the PKR performed better than some of the other top currencies. It increased by 95 paisas in relation to the Euro (EUR) and by Rs. 1 against the British pound (GBP) (GBP).

In the current interbank foreign exchange market, it gained five paisas against the Australian Dollar (AUD), 23 paisas against the Saudi Riyal (SAR), 24 paisas against the UAE Dirham (AED), and 25 paisas against the Canadian Dollar (CAD).